The Post Office Fixed Deposit scheme is a trusty savings option for the Indian investor in 2026. Backed by the Government of India, these Post Office FDs provide securities at par with any other approved option, stable returns, and regular income-generating facilities. A Post Office FD calculator helps the investor get an estimate of investments’ growth over time, thus allowing the investor to put in their money after this calculation.

What do you mean by Post Office FD Calculator?

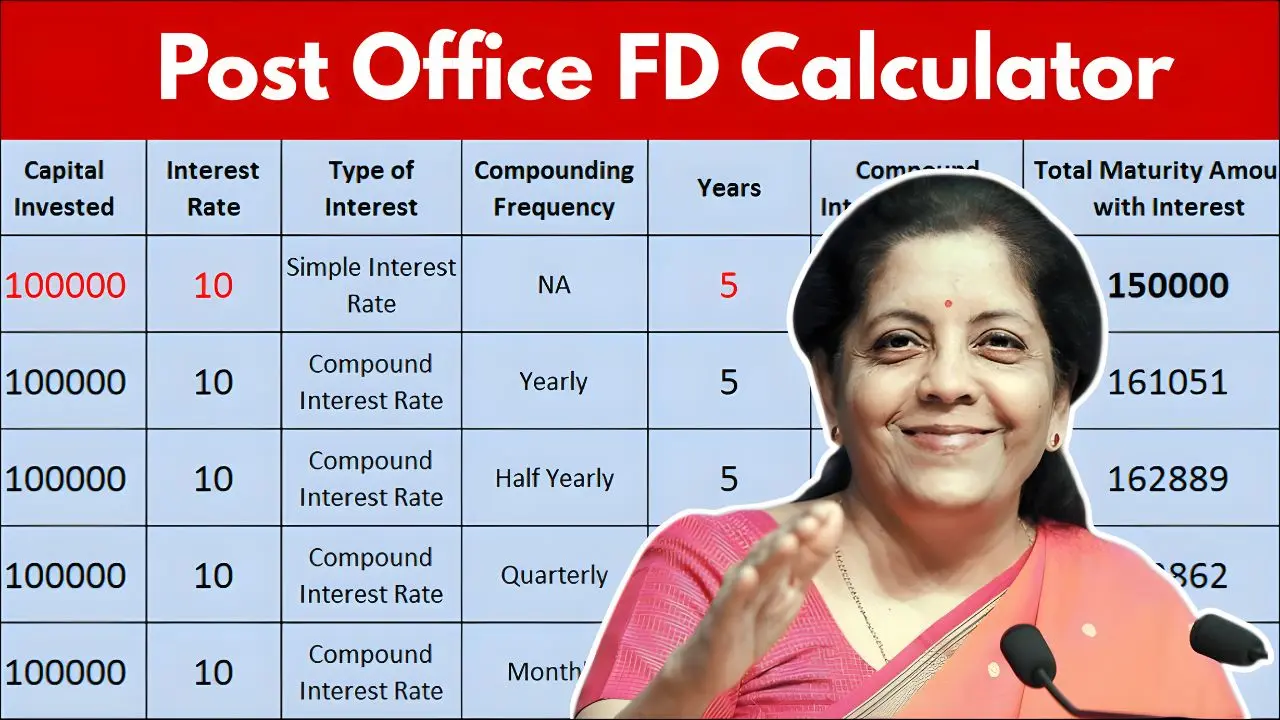

The Post Office FD calculator is a financial tool that helps the investor calculate the maturity amount and also get interest income on the funds locked into the FD. One just has to enter values like the amount, tenure, and relevant interest rate, and a calculator can immediately offer one the maturity amount. This, in turn, will encourage one to learn different tenors that can eventually promote better financial planning.

Interest Rates on Post Office FDs in 2026.

Post Office Fixed Deposits remain quite attractive in interest rate, though with Mr Rana seeking nirvana, when we juxtapose it with the many fixed deposits available in various banks and schemes of Post Office Fixed Deposits. Such interest rates happen to be variable from tenure to tenure, ranging for a minimum of one year to one of the most attractive tended to five-year periods of maturity. Such interest, in quarterly compounding and on an annual payout basis, makes this FD ideal for those seeking to have sustained and guaranteed growth alongside minimal risk.

How the Calculator Helps in Financial Planning

Using the Po FD calculator gives the investor an informed idea of what to look for. The system, for instance, tells you exactly how much interest you would earn over the period and what the total maturity would be. This scenario is particularly helpful for retired individuals, conservative investors, and others who want to meet short-mid term financial goals such as funding their children’s education, emergency funds, vacation, replacement of assets, or still buying a plot.

Who Should Use the Post Office FD Calculator

Senior citizens, salaried persons, and first-time investors who prefer having a clear picture before they invest are perfect candidates to use the calculator. The Post Office FDs have government backing; hence, they appeal to investors who are very cautious on risk and are particularly conscious of capital protection rather than a high rate of return. The calculator is available to help those investors vein through the two prevailing questions in their mind like reinvest or placement in other saving instruments.

Advantages of Post Office Fixed Deposits

With Post Office FDs, you always get partial relief from a market risk, which is clearly mentioned in the box written on page Bank Fixed Deposits or Company Fixed Deposits. There is a completely guaranteed return to be expected; there is nothing else to look for. This is the most traditional amicable way to open an account. In accessibility terms, these are best suited to semi-urban and rural areas with a minimal proportion of banks. The calculator provides a synthetically greater level of investor confidence.

Final Thoughts

The Post Office FD Calculator 2026 is a simple, down-to-earth, and yet comprehensive tool for anyone looking for a safe and stolid investment. In this way, investors can successfully ponder over foresight, plan the expense cautiously, and hit the nail on the head in terms of honing their skills towards long-term oriented mental calibration.