As discussions around the 2026 Pay Commission gain momentum, one topic drawing the most attention among government employees is the Dearness Allowance merger. A DA merger has historically played a major role in reshaping salary structures, basic pay calculations and long-term benefits. With inflation levels remaining elevated and DA crossing significant thresholds, expectations around its merger into basic pay are rising sharply.

What Is DA Merger and Why It Matters

Dearness Allowance is paid to government employees and pensioners to offset inflation. When DA reaches a certain level, it is often merged with basic pay during a new Pay Commission implementation. This merger permanently increases basic salary, which then becomes the foundation for calculating future allowances, pensions and retirement benefits. For employees, a DA merger is more than a temporary hike, as it reshapes income for years to come.

Why 2026 Is a Crucial Year

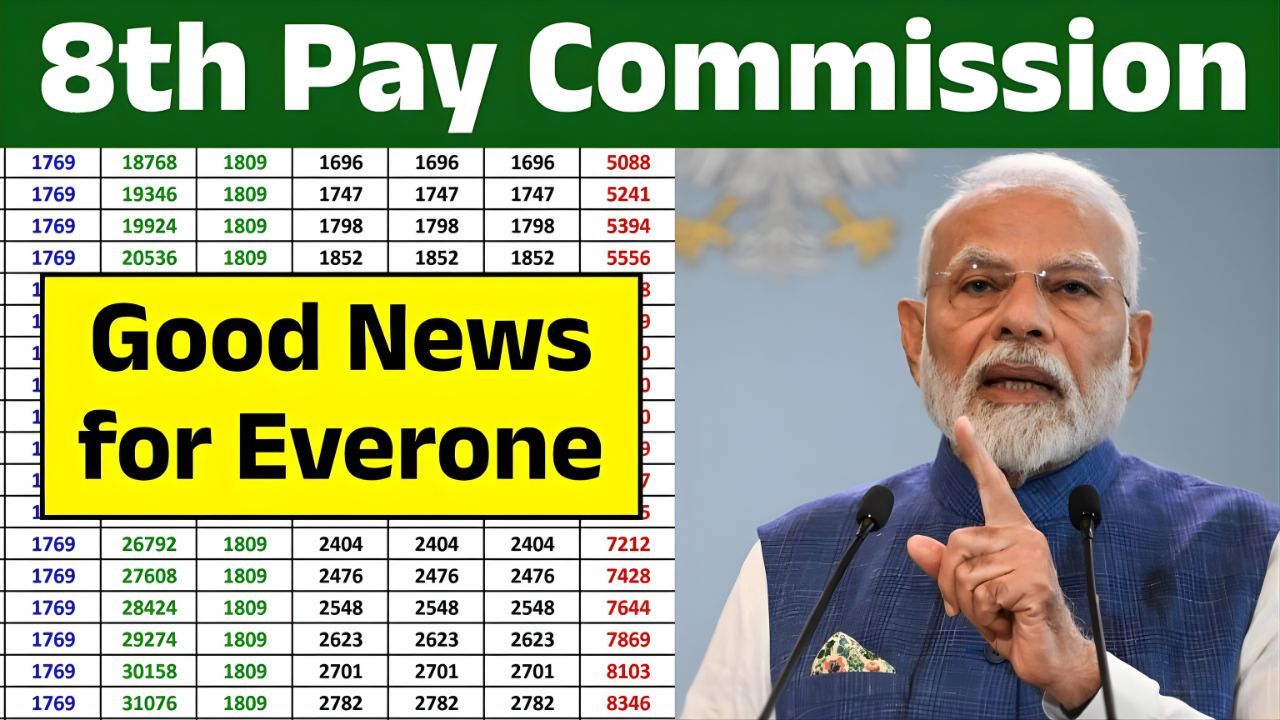

The year 2026 is significant because it aligns with the expected implementation timeline of the 8th Pay Commission. Historically, DA mergers have occurred when DA crosses specific benchmarks before a new pay structure is rolled out. With DA levels steadily climbing, the possibility of a merger before or during the 2026 Pay Commission is being closely watched by employees across departments.

How DA Merger Impacts Basic Salary

When DA is merged into basic pay, the existing basic salary is revised upward. This revised basic pay then becomes the new base for calculating House Rent Allowance, Travel Allowance and other benefits. Even if DA percentages are reset after the merger, employees often experience a net gain because future DA hikes apply to a higher basic amount.

Impact on Monthly Take-Home Pay

A DA merger can significantly raise monthly take-home pay, even if immediate increments appear moderate. Since multiple allowances are linked to basic pay, the ripple effect of the merger increases overall compensation. Over time, as fresh DA revisions are applied on the enhanced base, the cumulative benefit becomes more substantial.

Effect on Pensions and Retirement Benefits

Pension calculations are directly tied to last drawn basic pay. A DA merger therefore benefits not only serving employees but also future retirees. Higher basic pay leads to higher pension amounts, enhanced gratuity and improved commutation values. This makes DA merger particularly important for employees nearing retirement.

Will DA Be Reset After the Merger

Traditionally, after a DA merger, the DA percentage is reset to zero and starts building again from the revised base pay. While this may appear like a rollback on paper, employees are not financially disadvantaged because the basic pay itself has increased. Future DA increases then compound benefits further.

Who Benefits the Most From DA Merger

Employees in lower and mid-level pay bands often see the most visible improvement because a larger portion of their income is DA-linked. Pensioners also benefit indirectly through recalculated pension amounts. Long-term employees gain the most as the merger affects their entire remaining service period and retirement payouts.

What Employees Should Watch Going Forward

Government announcements, Pay Commission terms of reference and DA percentage movements will be key indicators. Employees should closely track inflation data and official statements, as these often signal whether a merger decision is nearing. Financial planning should also factor in potential changes to tax liability due to higher basic pay.

Final Outlook

The 2026 Pay Commission is shaping up to be a major milestone for government employees, and the DA merger could be one of its most impactful outcomes. While official confirmation is still awaited, historical patterns suggest that DA merger discussions will intensify as implementation approaches. For employees, understanding these effects early helps in better financial and retirement planning.